The rumor suggesting Apple could potentially purchase Disney is once again looming. This time in the midst of the coronavirus outbreak, which has resulted in a huge stock market crash.

Stock prices are very low at the moment, making it a solid time for Apple to put in an offer. Disney stock has dipped 36 percent since last month, after the pandemic has forced the company to shut down its parks all around the world. Movie releases have been pushed back, too, and production on upcoming film and TV projects have also come to a halt. As if that wasn’t enough, Disney is facing issues over on ESPN as there are no live sports right now.

Apple stock has also taken a hit throughout the entire situation, but not as much, only dropping 26 percent since last month. Of course, Apple is a far larger company with an astounding $964.88 billion in market cap, while Disney sits at only $152.16 billion. All things considered, an article from Barron’s speculates that now is the time for Apple to make a move. The report also adds that this isn’t the first time there’s been chatter of Apple purchasing Disney.

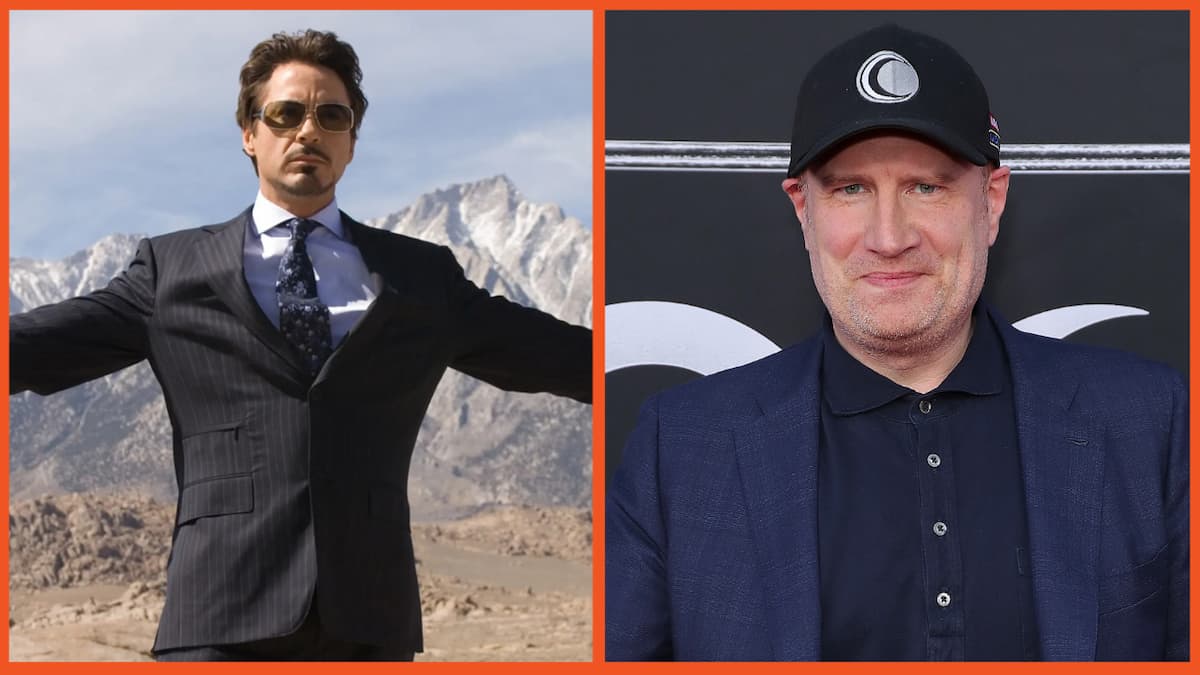

In 2006, after Disney purchased Pixar, then-Apple CEO Steve Jobs became Disney’s largest shareholder. It was then that speculation ran rampant about a potential merger. Outgoing Disney CEO Bob Iger also notes in his new book that, had Jobs not passed away in 2011, the merger likely would’ve happened. Despite the chaos hitting the market due to the coronavirus pandemic, Apple is still sitting healthy with $98 billion in net cash reserves, which could allow them to buy Disney “at the current fire-sale price.”

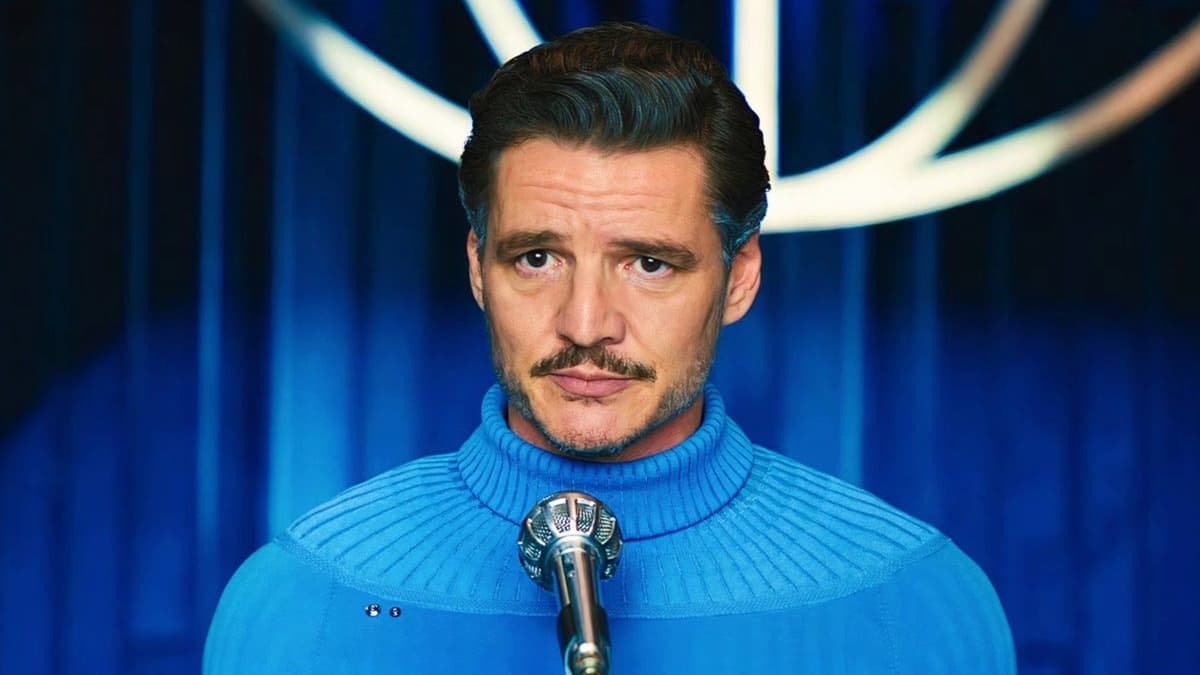

Rosenblatt Securities analyst Bernie McTernan added his own reasons for thinking the time for a purchase couldn’t be better. Iger is on his way out of Disney, the market is down, and Disney Plus has been a huge success right off the bat. Given Apple TV Plus has gotten off to a slow start, this could be the solution to Apple’s content issues. It should be stressed that McTernan is dealing in pure speculation, though, and Apple doesn’t really have a history of making big transactions.

In fact, their largest buyout goes back to their $3 billion purchase of the Beats headphone company in 2014. Also, there’s no guarantee that Disney is even interested in selling. There’s no real need for them to do so given their future is still bright in the longterm. With strong moneymakers in Star Wars, the MCU, their Disney parks, and more in their repertoire, Disney should be just fine when this all blows over.

Still, the fact remains that the company is losing tons of cash after being forced to close down its parks. Not to mention the delay in releases of highly-anticipated films such as Black Widow, New Mutants, Mulan, and Antlers. The filming of Shang-Chi in Australia has also stopped, reportedly costing the company $300,000 a day. Production on Disney Plus shows such as The Falcon and the Winter Soldier, WandaVision, and Loki are on hold, too. And with things only getting worse, who knows when the company will be able to resume their normal operations.

Published: Mar 24, 2020 01:01 pm