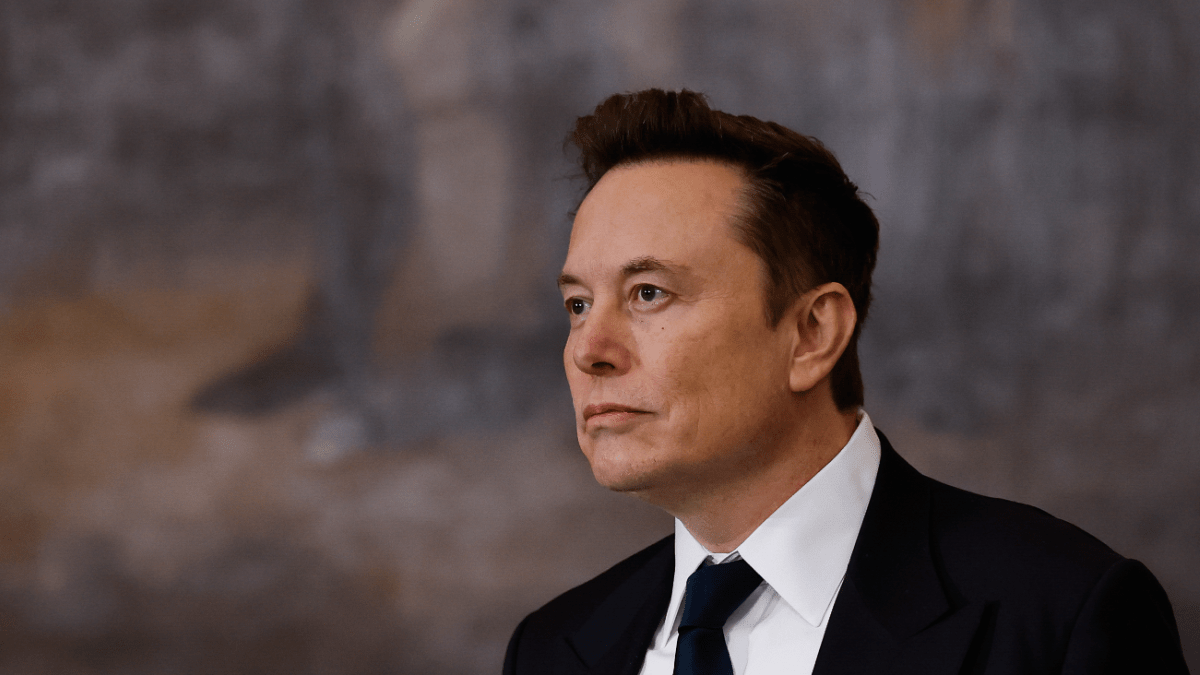

Billionaire Elon Musk recently dropped a financial bombshell, telling people they shouldn’t worry about “squirreling” money away for retirement because advances in artificial intelligence would supposedly make savings completely irrelevant. Musk believes AI and robotics are moving so fast that they will create so much productivity that scarcity will essentially disappear within the next 10 to 20 years.

That’s the futuristic core of his argument, according to Fox. In this utopian vision, goods become cheap, income becomes universal, and money just loses its overall importance. So he’s ignoring the bad parts of AI for now.

That sounds like a top-tier sci-fi movie plot, and it might even sound comforting if you don’t have a 401(k) plan. However, for everyday Americans trying to plan their financial lives, this is incredibly reckless advice.

Don’t squander your money in hopes AI will be used for good

Musk is a visionary entrepreneur, but he’s also worth hundreds of billions of dollars, fluctuating between $600 billion and $750 billion depending on the day. When you already have generational wealth, it’s easy to talk about a future where money doesn’t matter. Most families don’t have that luxury, and many are just scraping by while the future of Social Security remains an unknown.

Your retirement isn’t a science experiment that you can wait to launch. It’s groceries. It’s housing. It’s healthcare. It’s dignity. Those bills don’t wait for a technological revolution to arrive, and they certainly can’t be picked up by a Tesla.

A financial professional with nearly 35 years of experience pointed out the most dangerous part of Musk’s message: it encourages people to delay action. If someone in their 30s or 40s hears this and decides to stop contributing to their 401(k) or skip their Roth IRA, they lose the critical power of compound interest forever. You lose that incredible snowball effect. Compound interest works best when you start early, not when you’re hoping Silicon Valley will save the day. Hope is simply not a strategy.

We’re not talking about theoretical losses here. Let’s do some quick math. A 40-year-old who stops saving for 10 years, waiting for an AI miracle, could easily miss out on hundreds of thousands of dollars in future retirement income driven by real market returns. That’s a massive loss of real money.

Musk’s theory assumes three huge things all happen perfectly: technology advances precisely on schedule, wealth gets broadly distributed, and government systems adapt smoothly. History tells us that technological revolutions don’t spread benefits evenly. They usually concentrate wealth first and fix inequality later, if they ever fix it at all.

We can see this already in the real world. Ask factory workers displaced by automation, or retail employees replaced by self-checkout machines, or taxi drivers competing with ride-sharing apps. Technology doesn’t automatically equal financial security.

Meanwhile, back here in reality, Americans are facing rising healthcare costs, expensive housing, stubborn inflation, and record household debt. Social Security already faces long-term funding challenges, and pensions are disappearing entirely. Many workers don’t even have access to employer retirement plans. That’s the environment people are retiring into right now, and it’s clearly not a utopia.

Even if AI dramatically reshapes the economy, and it likely will, money will always buy something incredibly valuable called optionality. That’s the ability to have choices. Savings give you flexibility, independence, and negotiating power over how you live and when you stop working. They protect you from medical surprises, job disruptions, and market downturns.

A future with advanced technology doesn’t eliminate risk; it just changes the shape of it. Even in Musk’s dream world, someone still controls the machines. Someone still owns the platforms. Someone still collects the profits. Betting that those massive gains will automatically flow to everyone equally is optimistic at best.

Published: Feb 2, 2026 04:15 pm